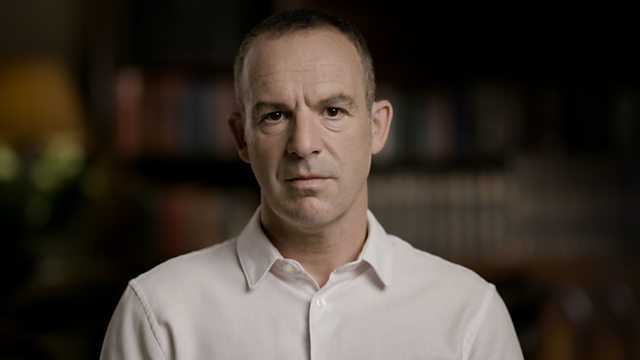

Episode 1

How politicians promised home ownership, but with policies that sent prices out of reach. Key figures from government, finance, and campaigning reveal the roots of the housing crisis.

Britain’s housing market is broken – but it didn’t have to be like this. For decades, politicians sold the dream of home ownership. But for millions of people, the reality is very different. People struggle to buy, and those lucky enough to own now face mortgage repayments among the highest in history. A priced-out generation contends with record rents, while ‘affordable’ housing feels anything but.

In this first episode, key figures from government, finance and campaigning reveal the roots of the housing crisis – and whose decisions led Britain here. In the boom before the financial crisis, when investors raced against first-time buyers to snap up property, the average British home doubled in price in just five years. After the crisis, quantitative easing and the ‘cocaine’ of Help to Buy ensure prices keep on rising. Who really got rich during these years – and why did it take government so long to realise there were also losers?

Last on

More episodes

Previous

You are at the first episode

Next

See all episodes from Britain’s Housing Crisis: What Went Wrong?

Broadcasts

- Tue 17 Oct 2023 21:00

- Sun 22 Oct 2023 18:20�������� Two England & HD only

- Tue 24 Oct 2023 02:35

Watch exclusive interviews with the programme’s contributors

Experts explore the differences with the UK housing market.